our range of

Responsible Funds

Ensuring Sustainable Performance

We offer our clients responsible investment solutions that combine financial and extra-financial strategy.

We offer our clients responsible investment solutions that combine financial and extra-financial strategy.

We align our sustainable fund offering with local regulations and the Disclosure Regulation applicable at EU level.

The Disclosure Regulation imposes obligations on financial actors to disclose sustainability information in order to provide greater transparency and a basis for comparison for the end investor.

Our range of responsible funds is structured according to its degree of sustainability

Our range of responsible funds is structured according to its degree of sustainability

Our teams are committed to measuring environmental and social externalities.

We report on our actions and progress to our investor clients through various dedicated reports.

We are up-to-date with the latest developments in institutional SRI policies.

Our methodology

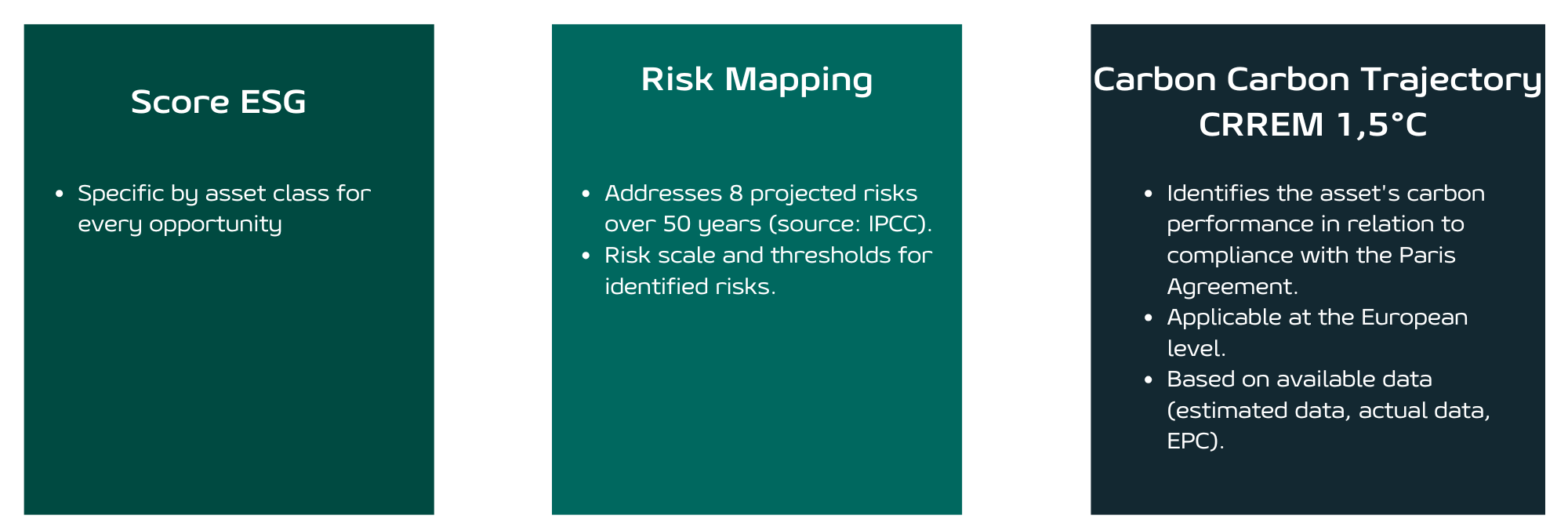

Each acquisition is subject to ESG due diligence.

Our methodology

Each acquisition is subject to ESG due diligence.

Learn more about our climate strategy

We are committed to continuously improving the environmental performance of our European real estate portfolio, with the main objective of achieving carbon neutrality by 2050 in accordance with the Paris Agreements.

Our portfolio, valued at +€38 billion of assets under management, spread over 10 different countries, invested in 5 asset classes (office, health/education, residential, retail, hotels) and totalling more than 1,625 buildings, implies a very broad spectrum of coverage of Praemial REIM's Environmental, Social and Governance (ESG) strategy.

Our portfolio, valued at +€38 billion of assets under management, spread over 10 different countries, invested in 5 asset classes (office, health/education, residential, retail, hotels) and totalling more than 1,625 buildings, implies a very broad spectrum of coverage of Praemial REIM's Environmental, Social and Governance (ESG) strategy.

et Firefox

et Firefox